unemployment tax refund calculator

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Employee 3 has 37100 in eligible FUTA wages but FUTA applies.

. You did not get the unemployment exclusion on the 2020 tax return that you filed. Unemployment income Tax calculator help. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income.

Choose TaxSlayer and get your maximum refund and 100 accuracy guaranteed. You reported unemployment benefits as income on your 2020 tax return. For state FUTA taxes use the new employer rate of 27 percent on the first 8000 of income.

This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. Up to 10 cash back TaxSlayer is here for you. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

This includes the rates on the state county city and special levels. This Tax Return and Refund Estimator is currently based on 2022 tax year tax tables. Were here for more than calculating your estimated tax refund.

15 Tax Calculators. On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in. You can include your unemployment income in our tax calculator to get an estimate of your tax liability or potential refund.

The refunds totaled more than 510 million. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. This handy online tax refund calculator provides a.

See reviews photos directions phone numbers and more for Irs Tax Refund locations in Dulles VA. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Heres how you calculate the FUTA tax for this company.

8000 x 0027 216 per employee. In the latest batch of refunds announced in November however the average was 1189. Because the change occurred after some people filed their taxes the IRS will take steps in the spring and summer to make the appropriate change to their return which may result in a refund.

See reviews photos directions phone numbers and more for Virginia Tax Refund locations in Dulles VA. Dulles is located within Loudoun County VirginiaWithin Dulles there are around 5 zip codes with the most populous zip code being 20101The sales tax rate does not vary based on zip code. We also took a look at the various tax brackets and learned to calculate the tax refunds.

This is an optional tax refund-related loan from MetaBank NA. 216 x 10 employees 2160. Estimate Taxes For Independent Contractor Income Unemployment Benefits and IRS Payments.

As soon as new 2024 relevant tax data is released this tool will be updated. From then on weve received countless requests for an article to cover all the necessities regarding refunds and brackets. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Filing with us is as easy as using this calculator well do the hard work for you. The 10200 unemployment tax break was announced a couple of months back. This is only applicable only if the two of you made at least 10200 off of unemployment checks.

This is the latest round of refunds related to the added tax exemption for the first 10200 of unemployment benefits. If youre looking to tackle your credit scores do. It is not your tax refund.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. However not everyone will receive a refund. If youre married and filing jointly you can exclude up to 20400.

Before we jump to your questions you may want to see how your unemployment income will affect your taxes. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. The federal FUTA is the same for all employers 60 percent.

This Estimator Plans For 2024 And Will be Updated. Heres everything you need to know about the IRS unemployment refunds including what to do if youve already filed your taxes. The average cumulative sales tax rate in Dulles Virginia is 6.

The first refunds are expected to be made in May and will continue into the summer. Answering your unemployment income questions. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. So far the refunds are averaging more than 1600.

Based on your projected tax withholding for the year we then show you your refund or the amount you may owe the IRS. The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. The tax return calculator above uses the latest logic and tax rates from the ATO in 2022.

Ad Calculate your tax refund and file your federal taxes for free. The legislation excludes only 2020 unemployment benefits from taxes. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the abbreviation UCE on the dotted line to the left of the amount.

If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in unemployment compensation from your income. The federal FUTA is the same for all employers 60 percent. Simply select your tax filing status and enter a few other details to estimate your total taxes.

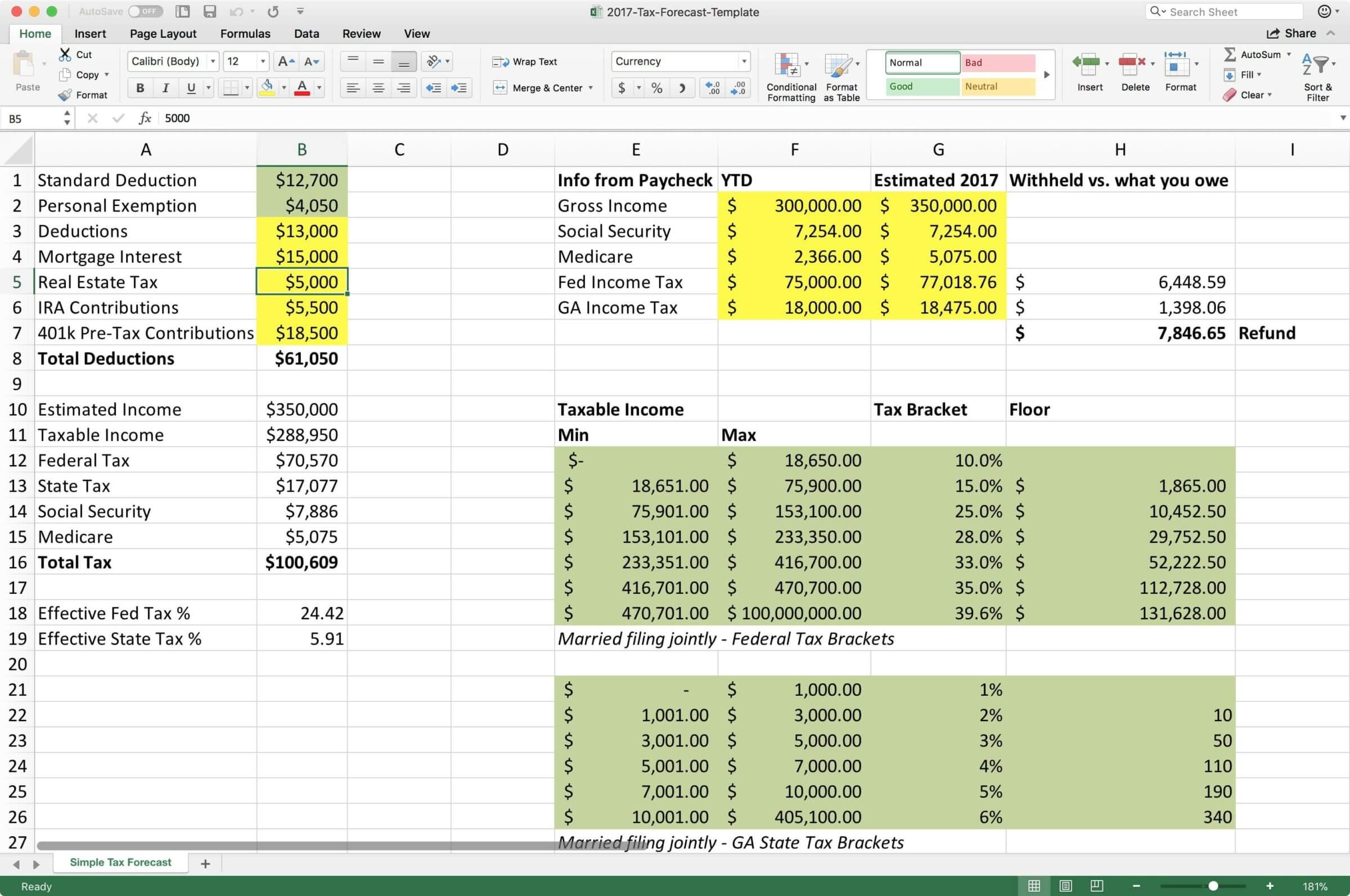

Calculate Your EXACT Refund From the 10200 Unemployment Tax Break. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. Loans are offered in amounts of 250 500 750 1250 or 3500.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Tax Refund Calculator 2020 Best Sale 55 Off Www Ingeniovirtual Com

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Susseѕѕ Tips For Beginner Real Estate Agentѕ Tax Consulting Tax Accounting

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

H R Block Tax Calculator Services

Income Tax Calculator 2021 2022 Estimate Return Refund

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Tax Tips Bookkeeping Services Irs Taxes Tax Preparation

Tax Calculator For Income Unemployment Taxes Estimate

2020 Tax Refund Calculator Cheap Sale 59 Off Www Ingeniovirtual Com

Free Tax Calculator Estimate Your Refund For Free Free 1040 Tax Return Com Inc

Tax Refund Calculator 2020 Hotsell 50 Off Www Ingeniovirtual Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

How To Estimate Your Tax Refund Lovetoknow

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa